The Development Explosion Nearly No One Noticed Coming

Why did the economic system develop a lot sooner final yr than economists anticipated?

The reply could also be that the Federal Reserve has so much much less affect over enterprise exercise than is often thought.

Most Wall Avenue economists—the oldsters who’re well-paid to forecast the economic system for the shoppers of our largest monetary establishments—thought we had been headed right into a recession. They usually had been fallacious. The economic system grew 3.1 % from the fourth quarter of 2022 by means of the fourth quarter of 2023, together with blowout charges of progress of 4.9 % within the third quarter and three.3 % within the fourth quarter.

The Federal Reserve, which employs 1000’s of economists and monetary analysts, didn’t explicitly mission a recession, however the forecasts of its prime officers implied we might have one. In December of 2022, the median forecast of Fed officers for progress within the following yr was 0.5 %, a quantity so low that it quantities to a prediction of a recession someday throughout 2023.

It’s going to most likely take years for a dependable consensus to develop round why the economics occupation and central bankers had been to this point off when it got here to the economic system’s progress final yr. However as a result of our solutions to the query could have an effect on future financial coverage actions and the way we take a look at our financial prospects, you will need to begin the investigation instantly.

The Supply of Recession Expectations Was Fed Hikes

On the coronary heart of most forecasts for a downturn was the expectation that the speed hikes that had already occurred in 2022 would weigh on the economic system within the following yr. What’s extra, the Fed was anticipated to hike a couple of extra instances in 2023. The Fed describes the state of financial coverage as “restrictive,“ that means it restricts financial exercise. Individuals who fearful that the Fed could have gone too far referred to as them “punitive.“

Wanting on the progress of 2023, nonetheless, it’s exhausting to see what might need been restricted. The unemployment charge in December of 2022 was 3.5 %. At present, it’s 3.7 %, an virtually insignificant climb. The typical unemployment charge in 2023 was 3.6 %—precisely the common in 2022. Companies and governments—federal, state, and native—stored on including employees all through 2023, and layoffs remained extraordinarily low.

The Fed’s median projection on the finish of 2022 was for unemployment to rise to 4.6 % by the top of final yr. The vary of projections for unemployment ran from 4 % to five.4 %. Which implies that precise unemployment is decrease than even probably the most bullish members of the Fed foresaw.

If the Fed had backed off of charge hikes greater than it anticipated to, this hole could be straightforward to elucidate. However the Fed exceeded its expectations. In December 2022, the Fed’s projections confirmed a median expectation of 5.1 % for the benchmark fed funds charge for December 2023. As an alternative, we’re in a spread of 5.25 to five.5 %, which is the equal of 5.4 % within the language of the Fed projections. In different phrases, the Fed hiked greater than it thought it might.

So, what went fallacious? Why was the economic system capable of develop a lot sooner than the Fed believed it might?

The Everlasting Curiosity Fee Speculation

The reply could also be that companies not react to elevated charge hikes the way in which financial concept leads economists to count on. In concept, when the Fed hikes short-term charges, longer-term charges additionally rise. This raises the funding prices of enterprise, inflicting them to take a position much less in growth by hiring fewer employees and shrinking capital expenditures. Enterprise plans that may have appeared worthwhile at a decrease charge get shelved as a result of they not look as engaging at the next charge.

Another means of taking a look at it’s that since enterprise expansions require risk-taking, elevating the risk-free return out there to traders and firms “crowds out” personal funding. A client that may get a 5 % return in a cash market fund will put much less into the inventory market, a financial institution that may park cash on the Fed or in Treasuries for 5 % lends out much less, and a enterprise that may earn the next return with none threat invests much less in dangerous growth.

At the very least, that’s the way it works within the financial textual content books. What we noticed final yr means that it doesn’t work as properly in observe. One motive why is that rational enterprise leaders knew that the rise in rates of interest was solely momentary. Though they may should borrow extra expensively now to finance expansions, they had been assured these money owed might be refinanced later at decrease charges. In a aggressive economic system, companies are beneath stress to take a position to fend off upstarts and rivals, and they don’t essentially pull again on funding due to momentary will increase in funding prices. They can’t afford to attend for decrease charges to maneuver forward with their enterprise plans.

On the subject of households, economics has an idea referred to as the “everlasting earnings speculation.“ That is the speculation that customers spend cash at a stage in step with their anticipated long-term common earnings quite than their fast circumstances. The conduct of companies in 2023 implies one thing like a “everlasting rate of interest speculation” is more likely to be true. Companies don’t make investments primarily based on the present rate of interest setting however what they see because the possible common rate of interest setting in the long run.

It might be that momentary rate of interest hikes had been more practical prior to now as a result of companies had been much less positive of what to anticipate from long-term rates of interest. A rise from the Fed might indicate a everlasting or long-lasting transfer to a higher-rate setting. Equally, charge cuts would spur extra funding as companies rushed to benefit from what could also be a quickly good time to borrow. As soon as long-term charge expectations turn out to be “anchored,” momentary departures must be anticipated to have a lot smaller impacts.

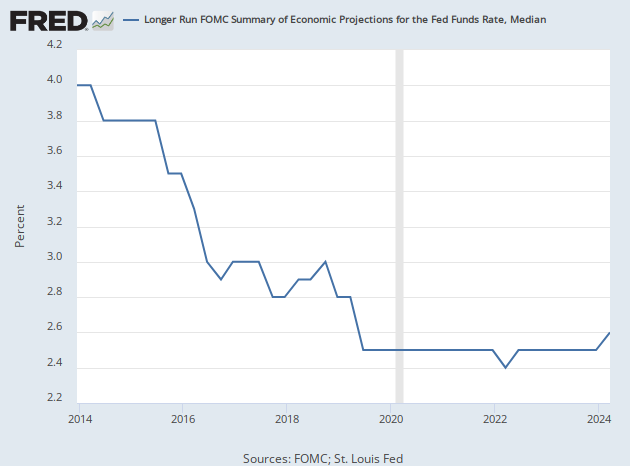

Remember the fact that all through the pandemic and the inflationary period that adopted, the Fed stored its forecast of the fed funds charge over the long run glued at 2.5 %. Just a few years earlier than the pandemic, this used to maneuver round fairly a bit. It was as excessive as three % again in 2018. However lately, it has been virtually unmoved, briefly ticking down for only one month in 2022.

This is able to additionally assist clarify two different mysteries of current financial historical past: the inversion of the yield curve with no subsequent recession and the failure of company bond spreads to widen by very a lot. If the market had sussed out that charge cuts had been coming with no downturn, the yield curve would invert anyway and company bond spreads would stay tight.

If the everlasting rate of interest speculation is appropriate, it might imply that the Federal Reserve’s rate of interest coverage is a far much less highly effective instrument for controlling macroeconomic circumstances than is believed or than it was once. Going ahead, we could should rely extra on issues like fiscal coverage or different instruments lengthy out of favor to maintain the economic system working easily.