’All people needs this challenge to be accomplished. It’ll make such an enormous distinction,” says Alberta Premier Danielle Smith of the Trans Mountain growth.

Article content material

It doesn’t take lots of creativeness to ascertain what a two-year delay to the Trans Mountain pipeline growth might imply to the province of Alberta or the Canadian oil sector.

Within the view of Alberta’s premier, it will be dangerous information.

Article content material

“Very involved about it, as a result of I believe there’s simply a lot pent-up demand” for extra pipeline capability out of the province, Danielle Smith mentioned in a year-end interview.

Commercial 2

Article content material

“All people needs this challenge to be accomplished. It’s going to make such an enormous distinction, not solely to us with the ability to get extra barrels bought, but additionally growing the worth of all of our barrels.”

The spectre of a possible two-year delay in getting the $30.9-billion challenge completed — as Trans Mountain Corp. not too long ago warned may very well be a worst-case situation — can be destructive information for producers who’ve been ready a decade to see the challenge constructed.

The Alberta authorities, which is able to profit from elevated oil manufacturing and extra royalties tied to the incremental transportation capability, would additionally really feel the pinch.

“Attending to the end line as shortly as attainable is the place we have to be,” Smith mentioned.

“I’ll proceed to cross my fingers that we get that line stuffed within the first quarter of subsequent 12 months.”

For a lot of Albertans who thought the Trans Mountain development story was shortly coming to an finish — I lump myself in that group — that assumption could have been untimely.

Is there no less than yet one more plot twist left on this long-running saga, or solely a footnote to wrap up?

The growth of the prevailing 1,150-kilometre oil pipeline, which runs from the Edmonton space to the B.C. coast, has already became an epic slog.

Article content material

Commercial 3

Article content material

The preliminary regulatory software to increase the prevailing pipeline was filed in 2013 and authorized three years later.

The growth will nearly triple the pipeline’s capability to 890,000 barrels per day, transferring extra crude and refined merchandise from Alberta to an export terminal in Burnaby, B.C.

After the earlier house owners, Kinder Morgan Canada, appeared ready to desert the challenge, Ottawa bought the road in 2018 for $4.4 billion.

Building was began, halted 5 days later as a consequence of a courtroom choice, then restarted. The pandemic hit, adopted by flooding, hovering inflation and provide chain points.

Since 2013, the challenge’s price ticket has escalated 472 per cent.

At the moment, the growth of the pipeline is 98 per cent full with solely about three kilometres of pipe left to put in.

Associated Tales

Trans Mountain Corp. CEO Daybreak Farrell mentioned in October she hoped to see the road being stuffed with oil in 2024, with the method beginning on the finish of January. Industrial operations have been anticipated to start by the top March.

Commercial 4

Article content material

But, there are not any simple slam dunks in relation to constructing main pipelines. The challenge is going through challenges in British Columbia due to the hardness of the rock and water inflows.

The Crown company utilized in October to the Canada Vitality Regulator (CER) for a variance associated to a brief 2.3-kilometre part, situated alongside the Fraser River close to Hope. It requested to put in a smaller 30-inch pipe, as a substitute of the deliberate 36-inch pipe, however the regulator turned it down.

Trans Mountain made a brand new software final week, saying that if it continues with the unique plan, there’s a “vital danger the borehole will grow to be compromised.”

If the drilling fails and Trans Mountain has to implement an alternate plan, the completion schedule may very well be delayed.

“Such a situation would end in incremental environmental disturbance and delay the (challenge) schedule by roughly two years, inflicting billions of {dollars} in losses to Trans Mountain, along with substantial third-party losses,” the company acknowledged in its newest submitting.

The interruption would result in about $200 million a month in delayed revenues and $190 million in carrying prices, in line with Trans Mountain.

Commercial 5

Article content material

Tristan Goodman, head of the Explorers and Producers Affiliation of Canada, mentioned a prolonged delay would doubtless immediate oil corporations to regulate their forecasted manufacturing estimates and financial budgets.

“To have this occur at this time limit, to be trustworthy, there’s no different method to describe this (than) preposterous,” Goodman mentioned Thursday.

“We’re nonetheless hopeful that it isn’t a two-year delay, but it surely’s fairly severe.”

For producers and the province, there’s a lot on the road.

An financial impression evaluation performed by Ernst & Younger for Trans Mountain final 12 months concluded that when the growth is working, it’s anticipated to contribute $9.2 billion in extra GDP throughout Canada over a 20-year interval.

The challenge will generate about $40 billion of royalties and taxes to Alberta over 20 years, Farrell mentioned.

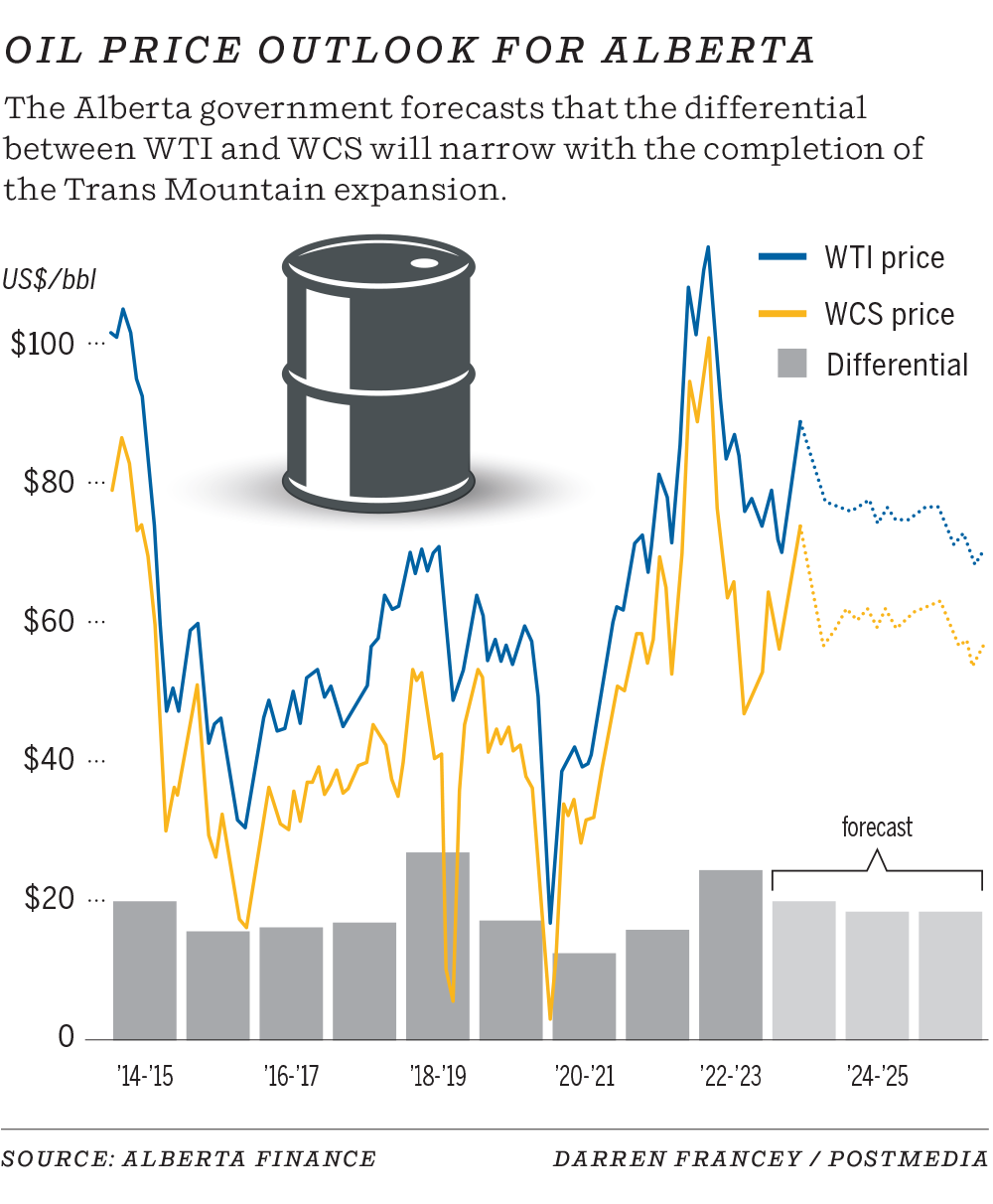

The pipeline growth will hand Canadian producers extra export capability, and it’s forecast to shrink the value unfold between U.S. benchmark West Texas Intermediate (WTI) crude and Western Canadian Choose heavy oil.

The differential stood round US$20 a barrel earlier this week, in line with ATB. The province’s fiscal replace in November mentioned finishing Trans Mountain would assist deliver the low cost right down to round $14 to $15 a barrel within the subsequent two years.

Commercial 6

Article content material

S&P International Commodity Insights expects Western Canadian oil provide to extend by 230,000 barrels per day (bpd) in 2024. Peak manufacturing in late 2024-25 might prime 5.2 million bpd.

“We nonetheless see the necessity for TMX in 2024 to be on-line for peak manufacturing,” mentioned Kevin Birn, S&P’s chief analyst of Canadian oil markets.

The business and the province shall be keenly watching what the CER decides on the brand new software.

Trans Mountain has requested a call by Jan. 9. On Thursday, the CER requested for extra info from the company.

Earlier within the week, the CER launched its written causes for the primary variance software, and mentioned Trans Mountain didn’t adequately deal with pipeline integrity and environmental safety issues.

But it surely seems Trans Mountain has addressed many of the CER’s key points in its new software, RBC Capital Markets analyst Greg Pardy mentioned in a notice.

Equally, a report by analyst Michael Dunn of Stifel mentioned the revised software will doubtless quell the regulator’s issues.

“We should look ahead to the CER to formally reply with its approval,” the Stifel report states.

“Nonetheless, it seems to be just like the anticipated startup of TMX . . . ought to clear what’s (hopefully) the ultimate regulatory hurdle.”

Chris Varcoe is a Calgary Herald columnist.

Article content material