The US labor market most likely remained sturdy whereas wage positive factors continued to ease as 2023 drew to a detailed, establishing for regular financial progress and waning inflation within the coming 12 months.

Article content

(Bloomberg) — The US labor market probably remained sturdy while wage gains continued to ease as 2023 drew to a close, setting up for steady economic growth and waning inflation in the coming year.

Government data on Friday are projected to show payrolls in the world’s largest economy increased by 170,000 in December. That would cap a year in which some 2.7 million jobs were added.

Advertisement 2

Article content material

Article content material

The median forecast in a Bloomberg survey of economists additionally requires a 3.9% improve in common hourly earnings from a 12 months earlier, the smallest annual acquire since mid-2021. The unemployment price is projected to tick as much as 3.8%.

Whereas the tempo of hiring is moderating, a resilient labor market helps views that the financial system will proceed to broaden in 2024, albeit at a slower price. That’s in line with the Federal Reserve’s newest financial projections. Fed officers additionally see inflation cooling.

On Wednesday, the central financial institution will challenge minutes of policymakers’ December assembly, at which officers signaled an finish to their aggressive marketing campaign of mountain climbing rates of interest. The Fed held its benchmark price on the highest stage since 2001 and penciled in no additional will increase.

The quarterly projections confirmed Fed officers anticipate to decrease charges by 75 foundation factors subsequent 12 months.

What Bloomberg Economics Says:

“Job positive factors have been concentrated in simply two acyclical sectors — well being care and authorities — with flat to detrimental progress in most industries. Consequently, wage progress will reasonable in December. Although a Fed pivot might have stunted recessionary dynamics within the labor market, that dynamic isn’t clear sufficient but, and our base case stays a persistent improve within the jobless price in 2024.”

Article content material

Commercial 3

Article content material

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full preview, click on right here

Additionally on Wednesday, the federal government will challenge figures on the variety of job openings throughout the financial system in November. Economists venture vacancies rose from a greater than two-year low a month earlier, whereas remaining in line with a moderation in labor demand.

The primary week of the brand new 12 months may even embrace intently watched surveys of producing and repair exercise in December.

- For extra, learn Bloomberg Economics’ full Week Forward for the US

In the meantime, in Canada, jobs information for December due on Friday will reveal whether or not the labor market continued to ease as 2023 got here to a detailed.

Elsewhere, a possible bump up in euro-zone inflation, together with buying supervisor surveys in China, might draw probably the most consideration as traders ease into the brand new 12 months.

Click on right here for what occurred final week and beneath is our wrap of what’s arising within the international financial system.

Asia

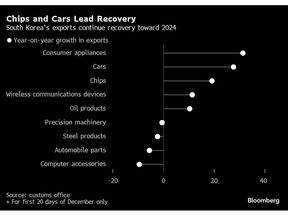

The 12 months begins with December export numbers from South Korea, an indicator that gives an early sign of the well being of world commerce and tech demand. Partial figures for the month already level to momentum in abroad gross sales carrying via to the top of the 12 months.

Commercial 4

Article content material

Additionally on Monday, Australian home-price information will present how the Reserve Financial institution of Australia’s rate of interest hikes — together with its newest transfer in November — are impacting the property market.

Following on from official buying managers index figures launched on the weekend, China’s Caixin manufacturing PMI will supply extra of a sign of how the nation’s private-sector factories are faring at a time when the pre-festive season peak for exporters has handed.

Likewise, PMIs for a number of different Asian economies, additionally due Tuesday, will fill out the image of the regional financial panorama initially of the 12 months.

Singapore’s financial system is anticipated to have slowed on a quarter-over-quarter foundation within the final three months of the 12 months.

All through the week, international locations will publish inflation information. Pakistan’s report comes on Monday, Thailand’s on Friday, with numbers from Indonesia, Taiwan and the Philippines additionally due. India releases a brand new forecast for 2024 gross home product on Friday.

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

Commercial 5

Article content material

For the euro zone, Monday will finish a multi-year suspension to the area’s fiscal guidelines geared toward paring debt, heralding a brand new period of consolidation. The regime was tweaked by finance ministers in a last-minute deal on Dec. 20.

The one forex will flip 25 on Monday, too, with European Central Financial institution President Christine Lagarde saying the euro has given Europe “higher sovereignty in a turbulent world.”

Her feedback — revealed in a joint op-ed with the heads of the European Fee, Council, Parliament and Eurogroup — have fun the endurance of a financial association whose disintegration was typically predicted.

Because the Greek disaster raged in 2015, for instance, former Fed Chairman Alan Greenspan reckoned that it was “only a matter of time earlier than everybody acknowledges that parting is one of the best technique.” Greece didn’t depart, and as an alternative, the area welcomed its twentieth member in 2023 when Croatia joined.

Other than that, ECB officers have a tendency to remain silent within the first week of the 12 months. Upfront of their inaugural choice of 2024 on Jan. 25, they might look ahead to PMI numbers from Italy and Spain, together with inflation information.

Commercial 6

Article content material

France and Germany will launch consumer-price numbers for December on Thursday, adopted by Italy and the euro zone as a complete on Friday.

A soar in inflation from 2.4% in November towards 3% is feasible, pushed by vitality base results.

The week may even be quiet within the UK, with closing PMI numbers, mortgage and consumer-credit information, and the Financial institution of England’s decision-maker panel — a survey that may assist define wage dangers — among the many highlights.

Inflation elsewhere may draw probably the most consideration. In Turkey on Wednesday, information might present consumer-price progress accelerated in December above 62% the earlier month.

Polish information on Friday will reveal whether or not inflation has slowed to the weakest tempo since September 2021.

In the meantime, on Monday, Israel’s first rate of interest reduce because the pandemic might be thought-about when the central financial institution opinions coverage. Economists are narrowly break up, however a slight majority that features most international lenders forecasts a quarter-point lower.

Although Israel’s central financial institution has repeatedly signaled that its focus is on preserving markets steady through the warfare in opposition to Hamas, now approaching the three-month mark, an easing of financial coverage is an choice as a result of the shekel has been appreciating sharply and inflation is slowing towards the goal vary for the primary time since early 2022.

Commercial 7

Article content material

With uncertainty nonetheless excessive, the chance of a broader battle may persuade the Financial institution of Israel to carry off for longer and solely begin chopping charges later, in tandem with the Fed subsequent 12 months.

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

Latin America

Peru kicks off the brand new 12 months for Latin America with its December client value report on Monday.

The central financial institution’s chief economist, Adrian Armas, expects inflation to finish 2023 close to the 1%-to-3% goal band from November’s 3.64% after consecutive months of deflation. The central financial institution sees the core print hitting the goal vary “on the finish of 2023” whereas the headline studying will achieve this in “coming months.”

The spotlight in Mexico might be minutes from Banxico’s Dec. 14 coverage assembly. Making good on a suggestion that they’ll maintain charges “for a while,” policymakers led by Governor Victoria Rodriguez saved the important thing price at a report 11.25% for a sixth straight assembly.

The median estimate of economists in Citi’s most up-to-date survey expects another maintain in February earlier than a quarter-point reduce in March.

Buying supervisor indexes for December are more likely to present that Mexico’s manufacturing continues to broaden, whereas Colombia’s and Brazil’s stay in recessionary territory.

Brazil’s industrial output information for November on Friday might replicate that weak spot.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Paul Abelsky, Brian Fowler, Paul Jackson, Robert Jameson and Laura Dhillon Kane.

Article content material