Inflation accelerated barely in November, marking the thirty-second consecutive month with annual costs rising considerably quicker than the 2 p.c goal seen as wholesome by the Federal Reserve.

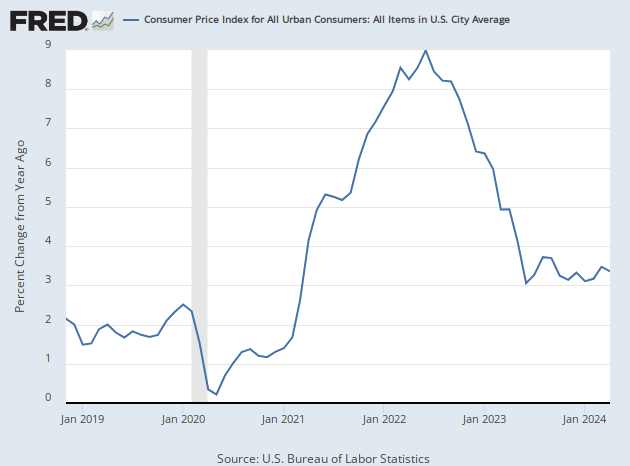

The patron-price index, the Labor Division’s broad measurement of what shoppers pay for items and providers, rose 3.1 in November from a 12 months earlier, a barely decrease annual price from October.

Shopper inflation hit its current peak of 9.2 p.c in June of 2022 and has since retreated because the Federal Reserve raised rates of interest at a file tempo and the Biden administration’s spending was reined in by lawmakers nervous about terribly giant price range deficits.

In contrast with the prior month, the consumer-price index rose 0.1 p.c in November, up from the flat month-to-month studying in October. Economists had been anticipating the Division of Labor to report one other flat month for inflation.

President Biden suffers from very low approval rankings, pushed by public dissatisfaction with excessive inflation and the administration’s management on financial points. Makes an attempt by the Biden administration to shift public opinion by claiming as achievements of “Bidenomics” that extra benign developments within the financial system, together with the return of unemployment to ranges final seen whereas Donald Trump was president, have largely backfired.

So-called core costs, which exclude unstable meals and vitality objects, rose 4 p.c in contrast with a 12 months in the past. From the earlier month, core costs rose by an anticipated 0.3 p.c, an acceleration from 0.2 p.c in October.

Shares and bonds have soared over the previous month or in order buyers determined that the Fed was not solely accomplished mountain climbing rates of interest however more likely to reduce within the first half of subsequent 12 months. The market is presently pricing in round 4 quarter-point price cuts subsequent 12 months. Yields on 10-year Treasuries have fallen to round 4.20 p.c, down by about 80 foundation factors from their current excessive in mid-October. The S&P 500 not too long ago hit 4,686, near its all-time closing excessive of 4772 reached in October of 2021.

Shares, bonds, and swaps linked to financial coverage have been little modified after the consumer-price indexes for November have been launched on Tuesday, suggesting the information did little to alter expectations for inflation or coverage.

Vitality costs declined sharply in November, falling 2.3 p.c in contrast with October, the second straight decline. In contrast with a 12 months in the past, vitality costs are down 5.4 p.c. Gasoline costs dropped six p.c within the month, bringing the annual decline to eight.9 p.c.

Companies costs excluding energy-related providers are up 5.5 p.c in contrast with a 12 months earlier. They rose 0.5 p.c in November in contrast with the prior month, an acceleration from the 0.3 p.c improve in October.

The costs of products excluding meals and vitality have been flat with a 12 months earlier. They fell once more in November from October, the sixth consecutive month-to-month decline. The costs of latest autos declined 0.1 p.c from the month, matching the prior month’s decline. In contrast with a 12 months in the past, new automobile and truck costs are up 1.3 p.c. Used automobile costs unexpectedly surged 1.3 p.c in contrast with the prior month however stay 3.8 p.c decrease than they have been a 12 months in the past, when the used automobile market was nonetheless beneath strain from automobile shortages linked to an inadequate provide of microchips.