European shares look primed to increase the rally seen throughout Asian markets and Wall Avenue, as traders place themselves for Federal Reserve interest-rate cuts subsequent 12 months. Gold traded close to a file excessive struck earlier this month.

Article content material

(Bloomberg) — European shares look primed to increase the rally seen throughout Asian markets and Wall Avenue, as traders place themselves for Federal Reserve interest-rate cuts subsequent 12 months. Gold traded close to a file excessive struck earlier this month.

Most-active futures contract tied to Euro Stoxx 600 Index rose 0.2% after a gauge of Asian equities rallied for the fourth straight session, its longest run since early November. US shares futures additionally pointed to an extension of Wednesday’s positive aspects on Wall Avenue later within the day.

Commercial 2

Article content material

Article content material

The rally in world bonds unfold to Asia with sovereign debt in Australia and New Zealand rising after yields on five- to 30-year Treasuries fell a minimum of 10 foundation factors on Wednesday, and Germany’s 10-year yields dropped to a recent 2023 low. The positive aspects pushed one world measure of the bond market to the cusp of its finest two-month rally on file.

Expectations of aggressive coverage easing are getting front-loaded, stated Vishnu Varathan, head of economics and technique at Mizuho Financial institution Ltd. in Singapore. “The ferocity of the bond market rally has actually augmented the overall returns for traders — there’s a sense markets are signaling we’re heading half-way towards simple financial coverage once more,” he stated.

Positive aspects in Asia had been led by Chinese language shares, which had been headed for his or her finest day in 4 months, boosted by a rotation into a few of 2023’s worst-performing sectors. Shares additionally rallied in Hong Kong, India and Australia.

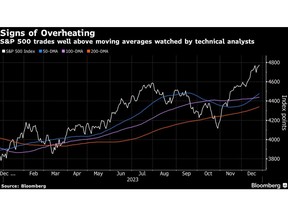

A measure of world equities is on tempo for its highest shut since February 2022, up greater than 15% from its October low, reflecting merchants’ optimism for rate of interest cuts subsequent 12 months. Merchants have stepped up bets on Fed price cuts as early as March, in response to Fed swaps pricing. A view that has gained momentum since policymakers up to date their forecasts this month to indicate they anticipate to scale back borrowing prices at a stronger tempo than indicated of their earlier projections.

Article content material

Commercial 3

Article content material

The positive aspects in bonds had been helped by bumper demand for five-year Treasury notes Wednesday, which itself adopted sturdy urge for food for a two-year public sale the day earlier than. Robust urge for food for the paper is an indication traders wish to lock in engaging yields previous to anticipated Fed cuts. Treasury yields had been regular in Asian buying and selling. The US greenback dropped towards all its Group-of-10 friends, with the Australian greenback rising to the strongest degree since July.

In Asia, the yen gained for the second day after Financial institution of Japan Governor Kazuo Ueda continued to organize the bottom for the nation’s first rate of interest improve since 2007.

“It’s potential to make some selections even when the financial institution doesn’t have the total outcomes of spring wage negotiations from small- and middle-sized companies,” the governor stated in an interview with public broadcaster NHK launched Wednesday.

China’s CSI 300 Index is headed for the primary weekly achieve since early November, with expertise and renewable vitality shares contributing essentially the most to the rally Thursday.

Japan industrial output slowed much less in November than economists forecast. Different information on the docket for launch contains commerce information for Hong Kong and Thailand, and the November price range steadiness for the Philippines.

Commercial 4

Article content material

Gold neared a file, whereas oil steadied amid indicators of constructing US stockpiles. Elsewhere, Bitcoin inched greater, buying and selling above $43,000 amid renewed hypothesis that the US Securities and Change Fee is getting near approving an exchange-traded fund investing instantly within the greatest token.

Key occasions this week:

- Japan industrial manufacturing, retail gross sales, Thursday

- US wholesale inventories, preliminary jobless claims, Thursday

- UK Nationwide home costs, Friday

A few of the principal strikes in markets:

Shares

- S&P 500 futures rose 0.1% as of 4:06 p.m. Tokyo time

- Nasdaq 100 futures rose 0.2%

- Hong Kong’s Grasp Seng rose 2.7%

- Euro Stoxx 50 futures rose 0.4%

Currencies

- The Bloomberg Greenback Spot Index fell 0.2%

- The euro rose 0.1% to $1.1117

- The Japanese yen rose 0.6% to 141.02 per greenback

- The offshore yuan rose 0.6% to 7.1079 per greenback

Cryptocurrencies

- Bitcoin fell 0.9% to $42,998.76

- Ether rose 0.5% to $2,373.04

Bonds

- The yield on 10-year Treasuries superior one foundation level to three.81%

- Australia’s 10-year yield declined eight foundation factors to three.89%

Commodities

- West Texas Intermediate crude rose 0.1% to $74.20 a barrel

- Spot gold rose 0.5% to $2,086.85 an oz.

This story was produced with the help of Bloomberg Automation.

—With help from Ruth Carson and Masaki Kondo.

(A earlier model corrected first paragraph to indicate gold traded close to a file)

Article content material