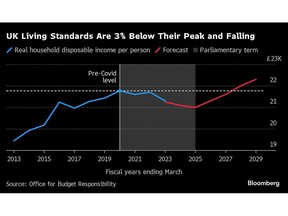

Fifteen years of financial stagnation have left the standard UK family £8,300 ($10,550) poorer than friends in nations like France and Germany, in line with a significant report on the state of the nation.

Article content material

(Bloomberg) — Fifteen years of financial stagnation have left the standard UK family £8,300 ($10,550) poorer than friends in nations like France and Germany, in line with a significant report on the state of the nation.

The discovering from the Decision Basis and the Centre for Financial Efficiency on the London College of Economics accompanied proposals to shake the UK out of its financial malaise by boosting progress, elevating residing requirements and reducing inequality.

Commercial 2

Article content material

Article content material

The 300 web page report may assist form the agenda for a Labour authorities underneath its chief Keir Starmer in the event that they win the following election.

The researchers proposed sweeping measures to spice up productiveness by closing the wealth hole between Britain’s cities, championing companies exports and rising public funding.

“The UK has now seen 15 years of relative decline, with productiveness progress at half the speed seen throughout different superior economies,” Decision mentioned within the 300-page ultimate report from its “Financial system 2030 Inquiry,” a collaboration with the LSE.

The duty is “large however not insurmountable,” Decision mentioned. Had been Britain to shut the typical revenue and inequality hole with Australia, Canada, France, Germany and the Netherlands, “the standard family could be 25% — £8,300 — higher off, with revenue positive factors of 37% for the poorest households.”

Starmer and Chancellor of the Exchequer Jeremy Hunt will converse at an occasion in London on Monday to launch the report, with additional feedback from Financial institution of England officers and outstanding economists.

The occasion displays rising considerations throughout the political spectrum about Britain’s lagging financial efficiency because the international monetary disaster in 2008. Development has slowed and productiveness, which is important to elevating residing requirements, has been significantly weak relative to equal nations.

Article content material

Commercial 3

Article content material

The federal government’s present plans “aren’t critical,” Decision mentioned, simply days after the Autumn Assertion, when Hunt lower £20 billion of taxes however signalled public companies confronted huge funds cuts.

Prime Minister Rishi Sunak has put boosting the economic system and slashing inflation on the coronary heart of the federal government’s agenda, claiming Labour’s plans would threaten the progress that has been made.

“We’ve got turned a nook,” Sunak advised reporters with him for the COP28 local weather talks in Dubai. “We’ve got grown the economic system, and we are actually targeted on controlling spending and controlling welfare so we are able to lower taxes. The Labour Celebration wish to borrow £28bn a 12 months. That’s simply going to push up inflation.”

Decision mentioned a brand new financial technique is required and politicians have to be sincere in regards to the commerce offs concerned. The suppose tank known as for extra public funding and funding for public companies, however mentioned taxes have to rise.

For now, the present technique has left the economic system sputtering and employees getting poorer in actual phrases as productiveness has fallen behind different comparable nations.

Consequently, Wages in Britain have flatlined, costing the typical employee £10,700 a 12 months in misplaced pay progress, in line with the report. 9 million youthful employees have by no means labored in an economic system with sustained common wage rises.

Commercial 4

Article content material

The findings chime with evaluation by Bloomberg economists Dan Hanson and Ana Andrade, who calculated that hourly labor productiveness within the UK is 24% under the place it might be had it maintained its pre-financial disaster pattern.

They discovered {that a} lack of funding defined 1 / 4 of the hole, with much less innovation and a slowdown within the adoption of latest concepts accounting for the rest.

What Bloomberg Economics Says …

“Jeremy Hunt came upon first hand in his Autumn Assertion how laborious it’s to maneuver the needle on the UK’s subdued long-term progress trajectory. On the coronary heart of the problem — unlocking quicker productiveness positive factors, which have slowed to a crawl over the previous 15 years. Lifting funding spending, aiding the movement of capital to the place it’s wanted most, benefiting from alternatives introduced by synthetic intelligence and opening up the economic system to commerce ought to all be a part of that plan. There’ll should be some powerful fiscal selections alongside the way in which.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click on for the INSIGHT.

Decision estimated that its plan may enhance gross home product by 7% over 15 years. Greater taxes and stronger progress are wanted to “elevate funding, rescue public companies, and restore public funds.”

Public capital spending must to three% of GDP to shut the residing requirements hole with comparable nations. The present authorities plans to chop funding to 1.8% of GDP by 2028-29. Funding ought to be more and more funded by home financial savings, not borrowing from overseas, it added.

—With help from Andrew Atkinson and Ellen Milligan.

Article content material