New York Metropolis, USA – Makalah Monroe works at an Outback Steakhouse in Laurel, Maryland. She is a pupil and the one one in her family with a automobile. By any account, Monroe has a full plate of tasks that she is working arduous to maintain up with. She works full-time and but struggles to get by.

“I usually depart an eight-hour shift with solely about $60 in hand,” Monroe advised Al Jazeera.

With bank card, cellphone and insurance coverage payments piling up, her present pay is simply not slicing it for her. Typically, she has to determine which will get paid and what has to attend.

“I often should name the automobile and insurance coverage firms and inform them I both have to pay late or pause funds fully,” she added.

Monroe is just like the tens of millions of People whose monetary scenario hinges on the end result of the US presidential election. President Joe Biden is about to give attention to quite a lot of financial wins throughout his first time period, together with report job progress, low unemployment and tumbling fuel costs, amongst different key financial indicators which have made it evident that the US financial system is on the upswing.

However the incumbent president, his Republican opponents, third-party candidates and Biden’s longshot Democratic challengers face the cruel realities of underemployment in america.

Nevertheless, with vital financial progress, the query is: Do People like Monroe have a greater likelihood for social mobility below the eventual Democratic nominee – most probably Biden – or the most probably Republican nominee, former President Donald Trump?

Based on knowledge compiled by the Financial Coverage Institute, underemployment sits barely under 7 % – the bottom because the company started monitoring the info in 1990. When Trump left workplace, underemployment was at greater than 14 %. After a peak in March 2021, there was a gentle decline since.

“For the reason that restoration from the COVID-19 pandemic, unemployment has declined fairly steeply and rapidly,” stated Lonnie Golden, professor of economics and labour-human sources on the Pennsylvania State College.

Value-of-living surge

Whereas the Biden administration noticed report job progress, it isn’t clear that the brand new jobs in query are well-paying sustainable jobs that meet the price of residing throughout the US.

“Within the final yr, we’ve seen an uptick in the way in which the Bureau of Labor Statistics measures the variety of folks working part-time however would like to be working full-time hours,” stated Golden.

“These figures form of masks the extent of underemployment for folks as a result of they’re searching for a second job for extra revenue,” she added.

Regardless of the financial positive factors, baby poverty is up 137 %, and common lease costs have surged nationally.

Based on a brand new report out from Zillow, the share of revenue wanted to lease a median-price condo within the US jumped by 40 % since earlier than the beginning of the COVID-19 pandemic.

In some cities, it’s even increased.

In Miami, Florida, renters have to spend 43 % of the common revenue to afford a median-price rental condo. The minimal wage in Miami is $12 an hour.

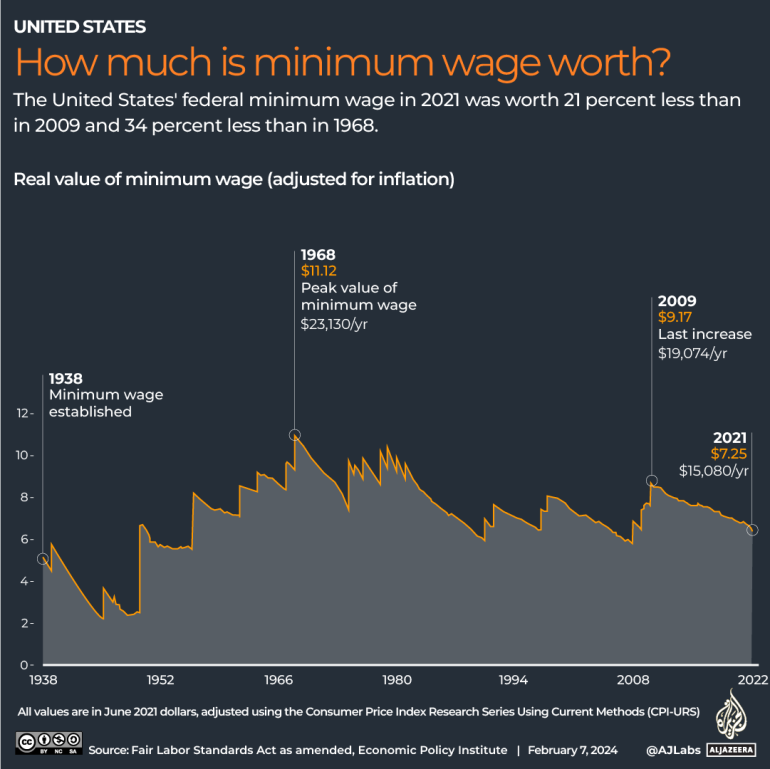

Nationally, the minimal wage’s shopping for energy peaked in 1968 and has not stored up with the price of residing since.

Based on a report by the Federal Reserve Financial institution of New York, the variety of these underemployed is way increased – 33 % amongst faculty graduates. That’s as a result of its metric considers graduates working jobs that don’t require a school diploma.

Amid the restoration, a lot of the constant job positive factors had been within the leisure and hospitality sector – an business that’s infamous for low wages.

“The low wage pool is what’s rising the American workforce,” Saru Jayaraman, founding father of One Honest Wage, advised Al Jazeera.

Jayaraman asserts that Biden, who traditionally is extra pro-worker than his Republican challengers, may do significantly better strategically if he absolutely embraces points about cost.

“It’s getting tougher and tougher to inform staff to vote for a Democrat who will elevate wages when that doesn’t occur,” Jayaraman stated.

Nevertheless, over the past election cycle, Biden did observe by means of on lots of his guarantees.

Certainly one of Biden’s first actions as president was to boost wages throughout the board by way of the Elevate the Wage Act. However that didn’t move because the invoice was blocked by Republicans. Biden, nevertheless, was capable of elevate the minimal wage for all federal contractors. The US authorities is the nation’s greatest employer.

Biden has not acted on abolishing the subminimum wage that permits tipped staff to make a wage of solely $2.13 an hour – though many states require increased direct wage quantities for tipped staff. The remaining is meant to be made up in ideas – a transfer that’s extensively accepted within the meals service business and different home industries.

The Trump administration, nevertheless, actively tried to restrict tipped wages for these similar restaurant staff. The previous president pushed for enterprise house owners to take management of ideas and move them alongside to staff as they see match.

Proposed options to underemployment embody quite a lot of compounding proposals, one in every of which is the nonprofit One Honest Wage’s push to abolish the subminimum wage nationally.

One Honest Wages efforts have helped get wage measures on the poll everywhere in the nation, garnering extra votes than both presidential candidate.

“In 2020, extra folks voted for a $15 minimal wage in Florida than [the number of votes for] both Trump or Biden,” Jayaraman stated.

Faults in proposed fixes

One proposed repair has been a Common Primary Revenue. People bought a style of that within the early days of the COVID-19 pandemic when the federal government launched one-time funds. That stimulated the financial system. Client spending surged.

In Might 2020, private spending rose 8.2 % from the month prior. That had the identical impact in the course of the second spherical of presidency payouts. Client spending ticked up by greater than 4 % within the months following the second launch, which was in early 2021.

Nevertheless, that was one of many many the reason why inflation soared within the years following.

Printing more cash implies that the person greenback is much less useful than it as soon as was, driving up costs. But wages didn’t develop almost quick sufficient.

“Just a few years in the past, it was that one in three People working full time lived in poverty. We’re inching nearer to at least one in two,” Jayaraman stated.

The Division of Labor for its half is taking steps to handle large shifts within the financial make-up of the US. In September, the division introduced a $57m grant to develop job coaching programmes, together with in giant inhabitants centres like New York, California, Illinois and Ohio.

The transfer is aimed toward serving to those that are underemployed pivot into high-demand and increasing industries associated to addressing local weather change and staffing up the US’s infrastructure tasks.

Whereas the programme is anticipated to have widespread results, the Labor Division says it would assist about 10,000 staff.

It additionally comes alongside a wave of unionisation efforts throughout huge companies like Amazon to even small impartial espresso outlets. A number of firms and commerce have efficiently lobbied for increased wages and fairer contracts.

That, nevertheless, got here from empowered staff in particular person sectors somewhat than overarching insurance policies from Washington.

The Biden administration has been largely supportive of unions which have referred to as for fairer contracts just like the United Auto Staff, for example.

Motion, nevertheless, is sluggish. Wage will increase are sometimes staggered marginally over a number of years. The required wage will increase for federal contractors had been unilaterally carried out by government order in April 2021 – three months into Biden’s presidency. It took impact just a few weeks in the past.

However as Washington hypothesises over a myriad of potential options, folks like Monroe nonetheless have lease and electrical energy payments piling up.

“I’m mainly residing paycheque to paycheque proper now,” Monroe stated.