Sydney recorded its highest share of houses promoting efficiently at public sale in additional than two years as Australians more and more anticipate rates of interest will fall and property-price positive factors quicken, in accordance with CoreLogic Inc.

Article content material

(Bloomberg) — Sydney recorded its highest share of houses promoting efficiently at public sale in additional than two years as Australians more and more anticipate rates of interest will fall and property-price positive factors quicken, in accordance with CoreLogic Inc.

Town, a market bellwether, reported 688 auctions up to now week for a preliminary clearance fee of 81.7%, the best studying since mid-October 2021, CoreLogic stated Sunday. The two,044 auctions nationwide was essentially the most this 12 months and noticed demand sustain with elevated provide, in accordance with the property consultancy.

Commercial 2

Article content material

Article content material

“The stronger public sale outcomes are attributable to greater than early-year seasonality,” stated Tim Lawless, analysis director at CoreLogic. “Some confidence has returned to the public sale markets amid falling inflation and a rising expectation that decrease rates of interest later this 12 months may see housing value development speed up.”

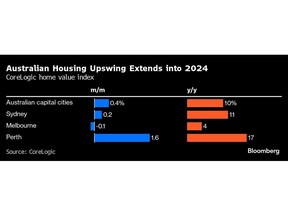

Property costs in Australia surprisingly resumed rising over the previous 12 months regardless of the Reserve Financial institution elevating charges to a 12-year excessive of 4.35% to fight inflation. A mixture of migration-driven inhabitants development and restricted provide attributable to spiraling building prices have mixed to defy tighter coverage.

Latest knowledge displaying a slowing in inflation imply merchants and economists anticipate the central financial institution’s subsequent transfer can be down. Commonwealth Financial institution of Australia, the nation’s largest lender, predicts six cuts beginning in September for a money fee of two.85% by June 2025. Cash markets are extra circumspect, pricing in two reductions over that interval.

Nonetheless, how Australia offers with excessive constructing prices which can be weighing on housing building goes to be an element within the trajectory of the property market.

Commercial 3

Article content material

Luci Ellis, chief economist at Westpac Banking Corp. and a former senior RBA official, highlighted in a analysis word on Friday that the costs of many constructing supplies are nonetheless rising in Australia, despite the fact that comparable knowledge for another nations present declines.

She stated that Canada’s surge in constructing prices peaked round mid-2022 and are actually 2% under that stage. “In distinction, home-building prices as measured within the Australian CPI have elevated by round 7% over the identical interval.”

CoreLogic says the approaching week will present an additional check of Australian housing demand, with one other pick-up in public sale exercise as round 2,800 houses are at present scheduled to “go underneath the hammer.”

Article content material