Pakistan is gearing up for 2 key occasions in fast succession: a common election and the expiry of an Worldwide Financial Fund bailout program. The election winner will likely be tasked with putting a brand new take care of the IMF, which buyers say is essential to the nation’s outlook.

Article content material

(Bloomberg) — Pakistan is gearing up for 2 key occasions in fast succession: a common election and the expiry of an Worldwide Financial Fund bailout program. The election winner will likely be tasked with putting a brand new take care of the IMF, which buyers say is essential to the nation’s outlook.

The nation heads to the polls to elect a brand new premier Feb. 8, whereas the IMF’s present rescue bundle ends in March, simply earlier than $1 billion in greenback bonds come due the next month. Pakistan’s funds will collapse with out a new funding settlement, in accordance with all 12 respondents to a Bloomberg survey.

Commercial 2

Article content material

Article content material

On the flip-side, if the brand new authorities is ready to agree on a recent IMF program then Pakistan’s belongings can prolong their world-beating rallies, in accordance with cash managers together with NBP Fund Administration Ltd. and Asia Frontier Capital Ltd.

“Buyers will watch how quickly the brand new authorities can negotiate a longer-and-larger mortgage program with the IMF,” stated Ruchir Desai, a fund supervisor at Asia Frontier Capital in Hong Kong. “Very discounted valuations, rates of interest peaking out and the prospects for an earnings restoration will add to the optimism surrounding higher political stability.”

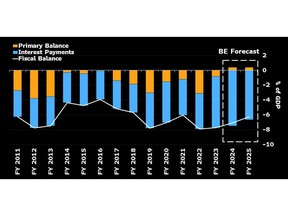

Getting access to a brand new spherical of IMF funding is vital to reviving Pakistan’s financial system and will assist the nation safe financing from different collectors equivalent to Saudi Arabia. The cash-strapped nation’s exterior financing necessities will common about $27 billion each fiscal 12 months from 2025 by means of 2028, the IMF has stated.

The primary contenders within the election are three-time former premier Nawaz Sharif, 35-year previous earlier overseas minister Bilawal Butto Zardari and sugar magnate Jahangir Tareen. The most well-liked candidate Imran Khan is successfully disqualified, being held in jail since final 12 months on corruption prices.

Article content material

Commercial 3

Article content material

Pakistan’s benchmark KSE-100 Index has jumped about 50% for the reason that nation reached an preliminary bailout take care of the IMF on the finish of June, the perfect performer of greater than 90 fairness indexes tracked by Bloomberg. The rupee has strengthened about 2% over the identical interval, beating all its Asian friends, whereas the worth of the nation’s greenback bonds due 2024 has nearly doubled from its low in June.

Even after the KSE-100 Index’s rally, the gauge remains to be buying and selling at a price-to-earnings ratio of simply 3.8, which is a reduction of 45% to its 10-year common. That’s even decrease than some international locations which have defaulted on their exterior debt.

“If the brand new authorities is available in and efficiently negotiates a brand new IMF program, we might even see the Pakistan rupee appreciating, rates of interest will come down, and the Pakistan inventory trade will surge again to 10-to-12 occasions P/E,” stated Adnan Sami Sheikh, an analyst at Pakistan Kuwait Funding Co. in Karachi.

Whereas the federal government is now in a greater negotiating place than it was earlier than final 12 months’s IMF deal, the Washington-based fund has stated Pakistan wants a market-determined trade charge, bigger overseas reserves to assist restrict exterior shocks, and a tighter financial stance to include inflation.

Commercial 4

Article content material

Pakistan has largely remained dedicated to these objectives. The central financial institution stored its benchmark rate of interest at 22% for a fifth assembly on Jan. 29 in an effort to curb the area’s quickest inflation charge, which has been propelled by rising vitality prices and the weak point of the forex in early 2023.

“Regardless of who wins and who loses the election, our insurance policies going ahead will principally be IMF-dictated,” stated Amjad Waheed, chief government officer in Karachi at NBP Fund Administration, which oversees about $820 million. “We are able to see some upside in equities. Inflation and rates of interest will transfer downward going ahead, which needs to be good for the bond market as effectively.”

Any steps taken by the following authorities to slender the fiscal deficit will assist utilities and oil-and-gas companies, whereas initiatives to enhance tax assortment will increase the general attraction of Pakistani belongings. Potential future cuts in central financial institution rates of interest as soon as the financial system returns to a surer footing can support cyclical sectors equivalent to supplies.

Analysts are divided on which of the potential new premiers could be finest positioned to supervise much-needed financial reforms.

Commercial 5

Article content material

Given Sharif and his occasion have beforehand carried out comparatively effectively at managing the financial system, buyers are most likely inserting bets on his comeback, in accordance with an evaluation by Bloomberg Intelligence. In the meantime, Gallup polls present former Prime Minister and cricket star Khan stays the nation’s hottest politician.

Historical past Lesson

Historical past reveals regardless of who wins, placing cash into Pakistan shares earlier than an election has reaped dividends. Those that purchased the KSE-100 Index the day earlier than a nationwide vote gained a median 7% over the next month, whereas the imply advance over a three-month interval was 19%, in accordance with information from the previous six elections compiled by Bloomberg.

Any such acquire this time spherical will rely upon whether or not the following chief can negotiate a bigger-and-better program with the IMF.

“We imagine the IMF will take into account sitting with the elected authorities for a longer-tenor program,” stated Amreen Soorani, head of analysis at JS International Capital Ltd. in Karachi. “Larger confidence ranges would enhance the prospects of eradicating unfavourable sentiment” that’s inflicting the present low multiples within the inventory market, she stated.

—With help from Chiranjivi Chakraborty, Ankur Shukla (Economist) and Faseeh Mangi.

Article content material