Two years after its default marked a key second in China’s property disaster, the world’s most indebted developer could also be heading for an additional bleak milestone: liquidation.

Article content material

(Bloomberg) — Two years after its default marked a key second in China’s property disaster, the world’s most indebted developer could also be heading for an additional bleak milestone: liquidation.

China Evergrande Group faces a Hong Kong court docket listening to on Monday over a creditor request to wind up the corporate, a lawsuit that’s lingered for about 18 months. The developer should persuade the decide that it has a concrete debt restructuring plan. Failure to take action will seemingly imply liquidation, resulting in extra chaos in its operations and additional denting sentiment within the housing market.

Commercial 2

Article content material

Article content material

“If Evergrande fails to ship an improved restructuring plan that meets the calls for of the advert hoc group of collectors, the Hong Kong court docket could be very prone to grant a winding-up order in opposition to the corporate,” stated Lance Jiang, a companion at regulation agency Ashurst LLP.

Evergrande is attempting to salvage its multi-billion greenback debt overhaul since a slew of setbacks derailed the method in current months. Within the newest twist forward of the court docket listening to, a gaggle of offshore collectors is demanding controlling fairness stakes within the developer and its two Hong Kong-listed items, folks with data of the matter stated.

Learn extra: Evergrande Collectors Demand Controlling Stakes in New Proposal

The so-called ad-hoc group of bondholders, which has stated it holds greater than $6 billion of the builder’s about $19 billion of offshore notes, desires the debt to be swapped for controlling stakes, the folks stated. Evergrande earlier proposed providing 17.8% of the mother or father and 30% of every of the subsidiaries — Evergrande Property Providers Group and China Evergrande New Vitality Automobile Group Ltd.

It’s unclear whether or not Evergrande has responded to the proposal or whether or not it should mark a step nearer to an settlement.

Article content material

Commercial 3

Article content material

The tight deadline forward of Monday’s session could immediate the developer to supply extra favorable phrases to win over bondholders, in keeping with CreditSights analyst Zerlina Zeng.

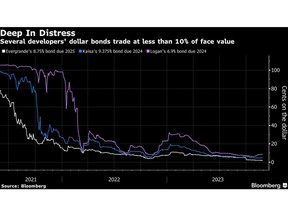

Evergrande, which has liabilities of about $327 billion, has change into the poster little one of China’s actual property debt disaster because it defaulted in December 2021. China has been releasing new measures to shore up the struggling sector, together with drafting a listing of builders that may be eligible for funding assist. However there may be little indication that Evergrande has benefited in any respect.

The developer scrapped creditor conferences on the final minute in late September and stated it could reassess its authentic restructuring proposal. In the identical month, its founder and chairman Hui Ka Yan was suspected of committing crimes and positioned underneath police management.

In the latest court docket listening to in October, Evergrande’s lawyer contended that the corporate was contemplating a brand new plan — one that may supply collectors new shares in its items, after the agency didn’t get hold of permission from Chinese language authorities to challenge bonds. That argument gained what Choose Linda Chan known as “a last adjournment.”

Commercial 4

Article content material

Any order to wind up Evergrande will additional complicate the image for collectors and homebuyers. One massive query is whether or not a liquidation choice by a Hong Kong decide could be acknowledged and carried out within the mainland. One other is what occurs to the progress of constructing presold houses — estimated at 604 billion yuan — that the corporate has but to ship.

“There will probably be important curiosity” within the listening to on Monday, stated Jiang. “Partly due to the sheer scale of the default, but additionally as a result of market members are very considering discovering out if the liquidator appointed in Hong Kong will probably be acknowledged in mainland China.”

—With help from Shuiyu Jing and Pearl Liu.

Article content material